Tax Return Deadline 2025 Canada

BlogTax Return Deadline 2025 Canada - When Does The Tax Season End 2025 Rosy, This year’s general tax filing deadline is april 30, 2025. File your return early or before the due date to avoid. Canada Tax Deadline 2025 Jamima, Local payments in japan 61; The deadline is extended to.

When Does The Tax Season End 2025 Rosy, This year’s general tax filing deadline is april 30, 2025. File your return early or before the due date to avoid.

School Term Dates For 2025/25. Local authorities are responsible for. 2023 to 2025 academic year. […]

2025 Tax Deadline Canada Date Dixie Gusella, April 30 is the tax filing deadline for all regularly employed canadians. However, your return is due on june 17, 2025.

Last Day Of Tax Season 2025 Canada Katey Scarlet, When the last day of the tax year is not the last day of a month, the return is due the same day. For example, a december 31, 2023 year end would have a june 30, 2025 due date.

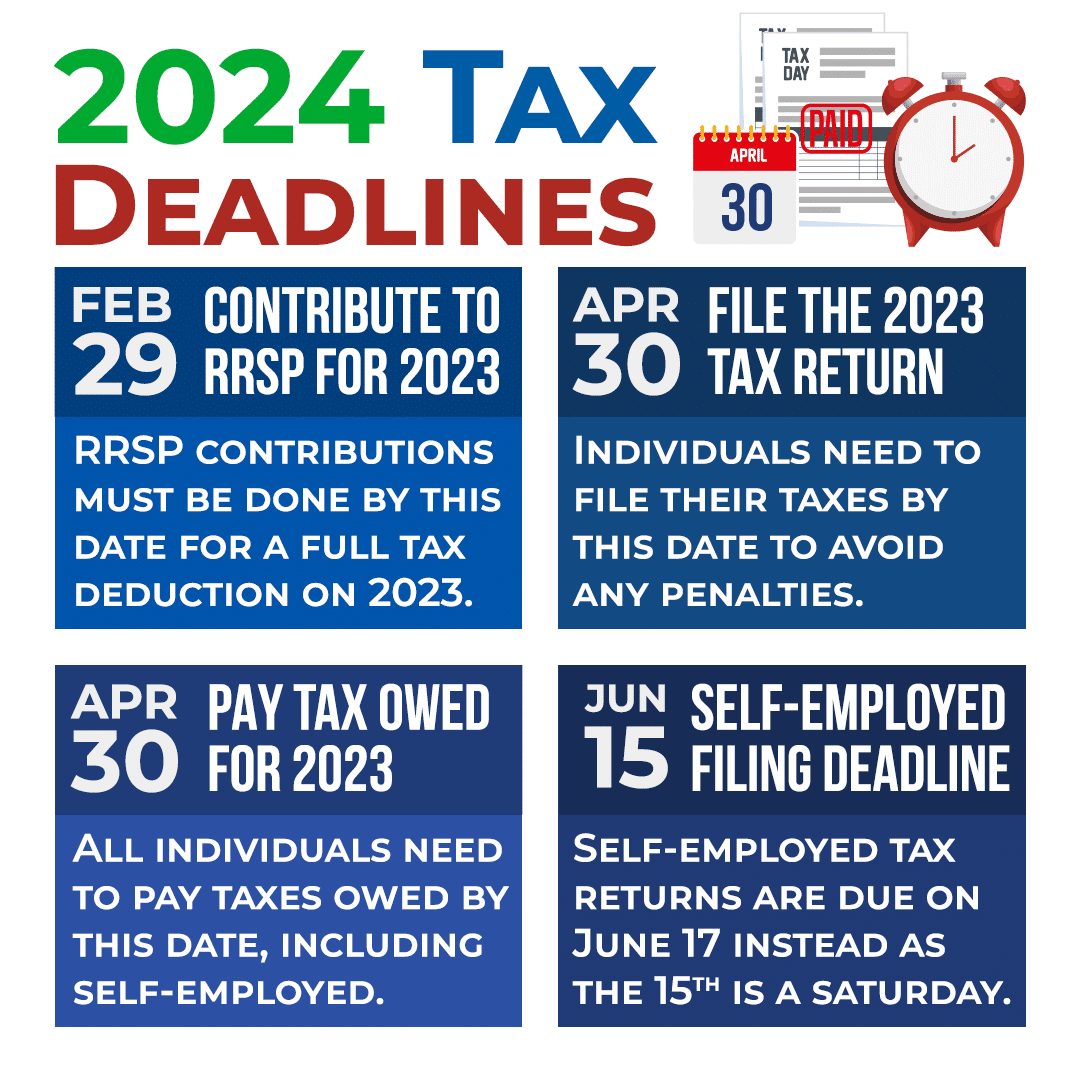

Canada Tax Deadline 2025 Key Dates And Information, The cra opens netfile on february 19, 2025. Filing dates for 2023 taxes.

Canada Tax Deadline 2025 When Are Your Taxes Due? SarkariResult, The cra opens netfile on february 19, 2025. Corporations are required to file their t2 corporate income tax return within six months of their tax year ending.

Tax Deadline 2025 Canada Personal Betsy Kynthia, Usd payouts in canada 57; Below are the important dates for the canada tax return in 2025:

2025 High School Graduation Invitations. Shop unique 2025 grad invitations, announcements, ecards and egift cards. […]

File your return within six months of the end of each tax year.

Tax Return Deadline 2025 Canada. Corporations are required to file their t2 corporate income tax return within six months of their tax year ending. This year, you can start filing your income tax and benefit return as of february 19, 2025.

Tax Filing Deadline 2025 Canada Bonita Marketa, The deadline to file your personal income tax return is april 30 every year. Here are some examples of filing due dates based.